Section 321 customs clearance is a vital aspect for individuals and businesses importing goods into the United States. It allows for the duty-free importation of goods valued at $800 or less, simplifying the process for low-value shipments. This provision not only eases the burden on customs authorities but also provides significant benefits for small importers looking to streamline their logistics.

Understanding the requirements and procedures involved in Section 321 can help importers navigate the complexities of customs clearance with greater ease. Compliance with specific regulations ensures that shipments are processed smoothly, reducing potential delays and unexpected costs.

With the ever-evolving landscape of international trade, staying informed about Section 321 is essential for anyone engaged in importing goods. The right knowledge can lead to more efficient logistics strategies and improved bottom lines.

Overview of Section 321

Section 321 provides a customs clearance framework that allows for expedited processing of certain low-value shipments into the United States. This section focuses on minimizing duties and streamlining the import process for eligible goods.

Understanding De Minimis Value

The de minimis value under Section 321 refers to a specific threshold for shipments entering the U.S. This value is set at $800. If a shipment’s total value is $800 or less, it qualifies for duty-free treatment and simplified customs procedures, meaning no tariffs are applied.

This provision is particularly beneficial for e-commerce businesses and individual consumers. It allows them to receive small packages without incurring additional fees. This threshold is applicable per shipment and can include multiple items, provided the total value does not exceed the limit.

Eligibility Criteria for Section 321

To qualify for Section 321, shipments must meet certain criteria. First, they must be for personal use or non-commercial purposes, rather than intended for resale.

Shipments should also not consist of prohibited items such as certain drugs, weapons, or restricted technologies. It is essential that the value of the item does not exceed $800, and the shipment must be imported by one individual per day.

Documentation is crucial, as the customs declaration must clearly state that the shipment is eligible under Section 321. Meeting these eligibility criteria helps ensure smooth processing and minimizes delays during customs clearance.

Procedures for Section 321 Clearance

Understanding the procedures for Section 321 customs clearance is essential for the efficient movement of goods. This process involves specific documentation and steps to ensure compliance with regulations.

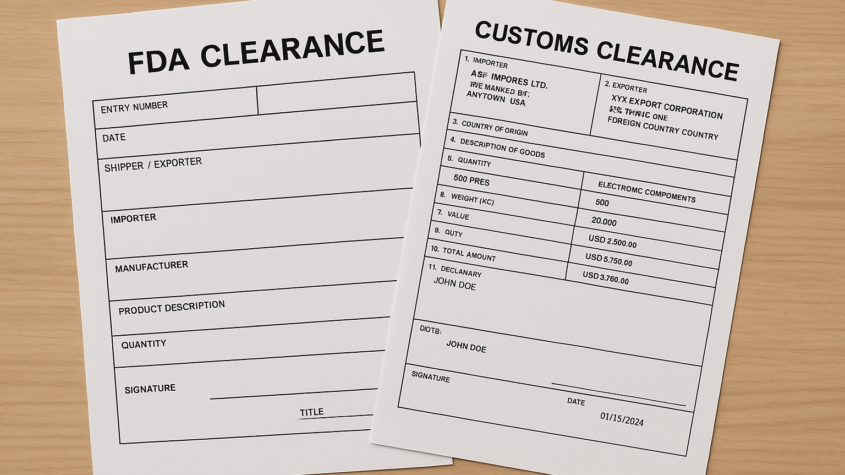

Required Documentation

For Section 321 clearance, specific documents are necessary to facilitate the process. The primary documentation includes:

- Commercial Invoice: Should detail the transaction, including the goods’ description, value, and terms of sale.

- Bill of Lading: Evidence of the shipment that provides shipment details and ownership.

- Entry Summary: A formal submission that summarizes the goods entering the country, which must indicate that the total value does not exceed $800.

All documents must be accurate and submitted in a timely manner to prevent delays. Supporting documentation may be required based on the nature of the goods.

Steps for Filing an Entry

Filing an entry for Section 321 can involve several clear steps. The process typically includes:

- Preparation of Documentation: Assemble all required documents including the commercial invoice and bill of lading.

- Electronic Submission: Utilize the Automated Commercial Environment (ACE) to submit entries electronically for faster processing.

- Payment of Duties: Ensure that no duties are required for shipments not exceeding the $800 threshold, but confirm any additional fees or compliance requirements.

- Confirmation: Monitor the submission status through ACE for confirmation of clearance and any further actions needed.

Adhering to these steps ensures a seamless entry process.

Customs and Border Protection (CBP) Processing

Once filed, Customs and Border Protection (CBP) processes the Section 321 entries. The processing involves:

- Review of Documentation: CBP checks the submitted documents for accuracy and completeness.

- Risk Assessment: Ships are assessed for compliance risks, and entries may be selected for further inspection.

- Approval Notification: If everything is in order, CBP will notify the importer of record that the goods have cleared customs.

Timely monitoring of the entry status is crucial. CBP aims for rapid processing within 24 hours for Section 321 clearances, positioning importers to retrieve goods efficiently.

Sympathy Flowers: Meaningful Gestures for Comfort and Support

Sympathy flowers serve as a heartfelt gesture during times of loss and grief. They provide…